Mastering Capital Project Financial Analysis: What Every Leader Needs to Know

Introduction:

Capital projects often involve significant investment, but without the right financial analysis, these projects can quickly turn from promising to problematic. Leaders involved in approving or managing capital projects need to understand not only the upfront costs but also the long-term financial implications, risks, and potential return on investment (ROI).

In this article, we’ll walk through key capital project financial analysis techniques. Whether you’re new to capital project management or looking to sharpen your skills, these insights will help you make data-driven, high-impact decisions.

1. The Importance of Financial Analysis in Capital Projects

Financial analysis is more than just crunching numbers; it’s a vital tool for understanding the viability and potential of a project. An effective analysis helps leaders:

- Evaluate ROI: Understanding the expected return on investment is crucial for prioritizing projects that offer the best financial value.

- Assess Risks: By evaluating the costs and potential setbacks, leaders can prepare for uncertainties and mitigate risks.

- Improve Decision-Making: Financial analysis brings objectivity to decision-making, helping leaders base approvals on facts rather than assumptions.

2. Key Components of Capital Project Financial Analysis

Net Present Value (NPV)

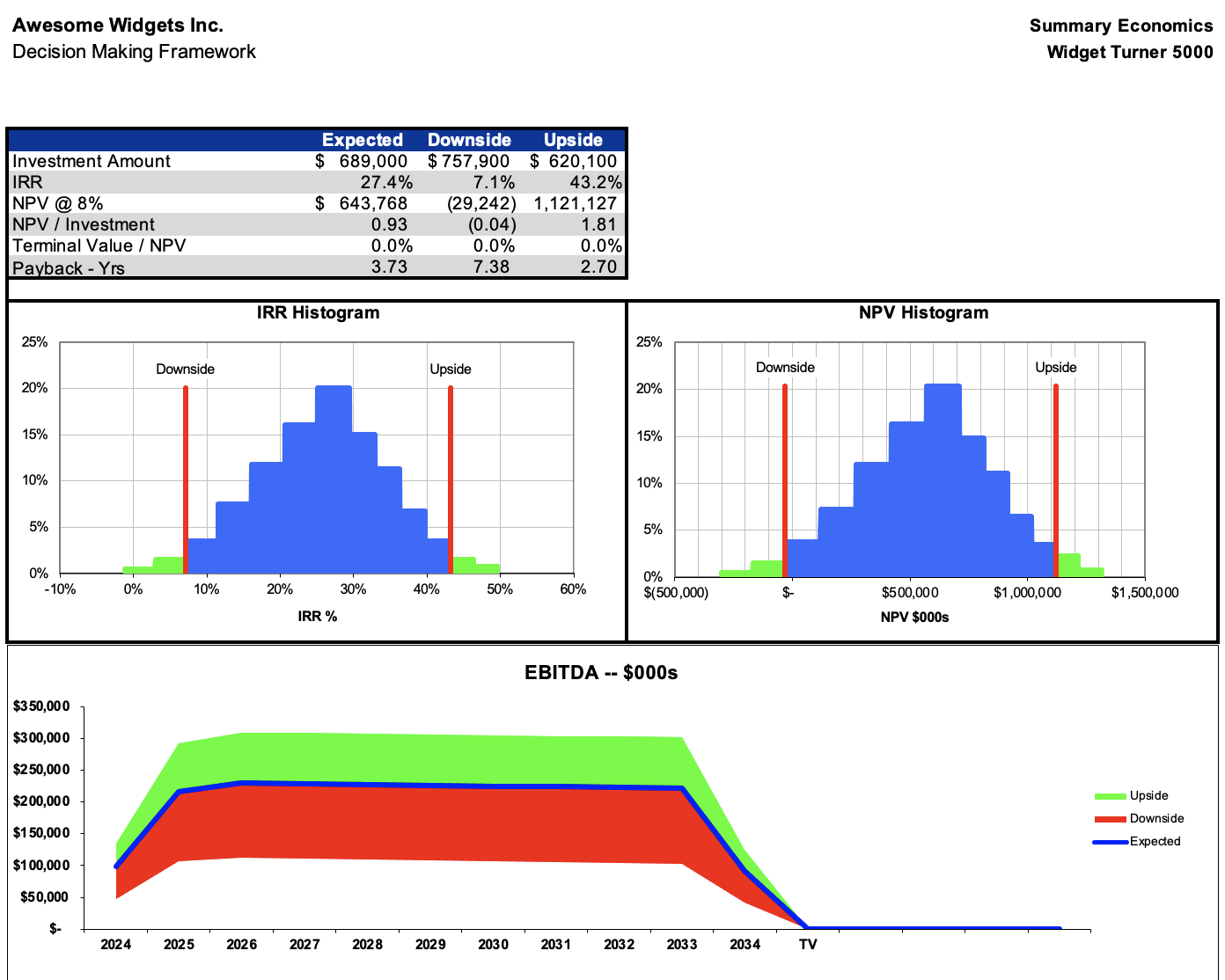

Net Present Value (NPV) is a standard financial metric that calculates the value of a project by comparing the present value of cash inflows with the present value of cash outflows. An NPV greater than zero typically indicates a project is worth pursuing, while a negative NPV suggests it might not deliver sufficient returns.

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is the discount rate at which the project’s NPV equals zero. A project with an IRR higher than the company’s cost of capital is generally a good investment, indicating potential profitability.

Payback Period

The payback period is the amount of time it takes for a project to recoup its initial investment. While shorter payback periods are preferable, especially in high-risk industries, they should be considered alongside other metrics like NPV and IRR.

Sensitivity Analysis

Sensitivity analysis assesses how changes in assumptions (like cost of materials or project timelines) impact the project’s financial performance. This helps leaders understand which variables have the most influence on project success, allowing for more targeted risk management.

You can download Enabling Empowerment’s DMF Excel Financial Model to calculate these metrics for you.

3. Steps to Conduct Effective Financial Analysis for Capital Projects Using the 7-Step Decision-Making Framework

Step 1: Define the Opportunity and Objectives

Clarify the objectives of your capital project from the outset. This initial step involves understanding the problem or opportunity at hand without jumping to solutions. For capital projects, this means clearly defining the project’s purpose, target outcomes, and alignment with strategic goals.

Step 2: Develop a Creative Range of Alternatives

Once you’ve defined the objectives, brainstorm a diverse set of alternatives to achieve the desired outcomes. In the context of capital project financial analysis, these alternatives could range from different project designs to alternative financing methods. Ensure each alternative is generated without immediate judgment to avoid the anchoring trap.

Step 3: Identify Key Drivers of Success

Identify the most influential factors (drivers) that will determine the success of the project. For capital projects, these drivers might include projected revenue growth, cost control, or operational efficiency improvements. Prioritize the key drivers that will deliver the majority of the desired impact, focusing on the 20% that contributes 80% of results.

Step 4: Manage Risks and Rewards

Consider both the potential risks and rewards for each alternative. Perform a detailed risk assessment and identify possible rewards, such as cost savings or revenue gains. For instance, if a project has a high potential for ROI but significant market risk, weigh these factors thoroughly and plan for mitigation strategies to handle worst-case scenarios.

Step 5: Conduct an Economic Analysis

This step involves analyzing the financial viability of each alternative, focusing on key financial metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and payback period. Calculate the financial impacts for both best-case and worst-case scenarios to help stakeholders understand the range of possible outcomes.

Step 6: Determine Required Capabilities and Next Steps

Evaluate the resources, skills, and budget necessary to bring the selected alternative to life. Capital projects often require specialized capabilities—whether in project management, engineering, or finance. Outline the specific capabilities needed, along with an actionable roadmap that details roles, responsibilities, and timelines. Check out this template to help you understand your best-case/worst-case plan.

Step 7: Show Your Work

Document your analysis and reasoning behind the chosen alternative. This transparency allows others to understand the decision-making process and provides a valuable reference for future projects. By “showing your work,” you not only enhance accountability but also create a learning opportunity to refine your decision-making process over time.

4. Common Challenges and How to Overcome Them

Challenge: Unreliable Forecasts

Even the best financial analysis is only as good as the data behind it. If assumptions are off, the entire analysis can become skewed.

- Solution: Use ranges of forecasts for variables like revenue growth, costs, and inflation. Regularly review and update forecasts as market conditions evolve.

Challenge: Lack of Consistency Across Projects

Inconsistent methodologies can make it difficult to compare projects effectively, leading to suboptimal investment decisions.

- Solution: Implement a standardized Decision-Making Framework that applies to all capital projects. This creates a “common language” for project evaluation.

Challenge: Overlooking Qualitative Factors

Financial analysis often focuses on quantitative data, but qualitative factors like strategic alignment and environmental impact are also important.

- Solution: Include a qualitative assessment as part of your financial analysis to provide a holistic view of the project’s value.

Conclusion:

Mastering capital project financial analysis is a powerful skill for any leader involved in approving or managing large investments. By understanding the financial metrics that drive ROI, leaders can make informed decisions that maximize value and reduce risk. With a solid framework for evaluating NPV, IRR, payback periods, and sensitivity, you’ll be well-equipped to identify the most promising projects and drive sustainable growth.

For a deeper dive into effective decision-making frameworks, consider purchasing Enabling Empowerment. It provides the tools and strategies you need to make data-driven, impactful decisions for your organization.

Call to Action (CTA):

Ready to improve your decision-making on capital projects? Purchase Enabling Empowerment for more in-depth insights, or schedule a meeting to learn how to apply these principles within your organization.